Diminishing balance formula

Depreciation amount opening balance depreciation rate. 2000 - 500 x 30 percent 450.

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

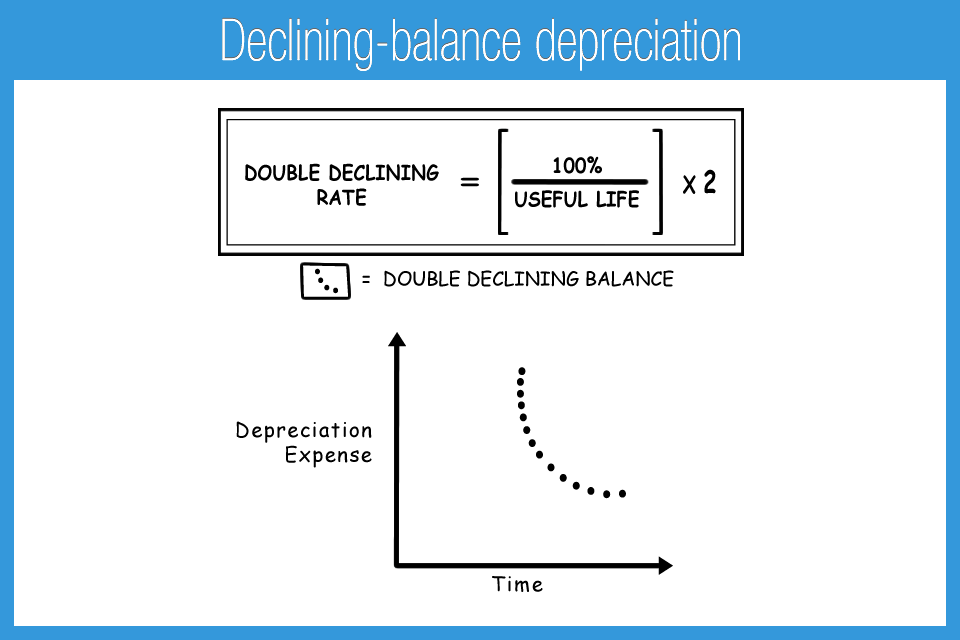

The basic formula for calculating the rate of depreciation to be used.

. Diminishing Balance Sample Computation for EasyPay Installment Transactions Assumptions. Calculate the rate of depreciation is 15Mr. Things to note in the above calculation.

2004 additions were made to the machinery of Rs. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non. The diminishing balance method is a.

The diminishing balance method is a method of calculating the depreciation expense of an asset for each accounting period. Closing balance opening balance depreciation amount. Thus the value of the equipment is diminished by Rs 10000 and becomes Rs 90000.

1235 - 500 x 30 percent 220. 1550 - 500 x 30 percent 315. Double Declining Balance Depreciation Method.

X wants to charge depreciation using the diminishing balance method and wants to know the amount of depreciation it should charge. 2003 machinery was purchased for Rs 80000. When using the diminishing value method.

Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. The total interest payable calculation is simple. But on downside this.

Declining Balance Method. Depreciation by Diminishing Balance Method On 1st Jan. The double declining balance depreciation method is one of two common methods a business uses to account for the.

Cardholder has no beginning balance on his first statement and makes EasyPay Installment. As it uses the reducing. What is diminishing reducing balance method.

For example the diminishing value depreciation rate for an asset expected to last four years is 375. The written down value at the end of the estimated useful life of the asset should equal the estimated salvage value. For the second year the depreciation charge will be made on the diminished value ie.

Depreciation amount 1750000 12 210000. The loan calculations will be as below.

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Formula Examples With Excel Template

Double Declining Balance Method Prepnuggets

Double Declining Balance Depreciation Method Youtube

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

Declining Balance Depreciation Double Entry Bookkeeping

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

What Is The Double Declining Balance Ddb Method Of Depreciation

Profitable Method Declining Balance Depreciation

Declining Balance Method Of Depreciation Formula Depreciation Guru

Double Declining Balance Method Of Depreciation Accounting Corner

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Double Declining Balance Depreciation Daily Business

Double Declining Balance Method Of Depreciation Accounting Corner